Following the implementation by the Customs Revenue and Control Agency (“ARCA”) of a special refund procedure for advance payments of the PAIS Tax for certain transactions in July, General Resolution No. 5765/2025 has now been published, through which the agency reinstates said procedure to cover cases not included in the prior stage.

Effective October 6, importers may apply for a refund of uncredited PAIS Tax amounts in connection with the following transactions:

- Imports of goods with customs clearance registered on or before December 12, 2023, for which:

- Access to the foreign exchange market (MULC) was not obtained, nor were peso-denominated subscriptions of BCRA-issued USD-denominated bonds or securities made;

- Access to the MULC was not obtained, and peso subscriptions were made to BCRA-issued USD bonds subject to a 0% PAIS Tax rate;

- Partial access to the MULC and/or 0%-rated BCRA USD bond subscriptions in pesos occurred.

- Imports of goods with customs clearance registered from December 13, 2023, to November 24, 2024, for which the PAIS Tax could not be credited, either due to lack of access to the MULC or because such access occurred after the tax had ceased to apply.

The filing period for refund applications will run from October 6 to November 19, 2025, and during this time, ARCA will reopen the “Register of Import Declarations with Uncredited Advance PAIS Tax Payments” (Registro de despachos de importación con pagos a cuenta no computados del Impuesto para una Argentina Inclusiva y Solidaria – PAIS) exclusively for the above-mentioned transactions.

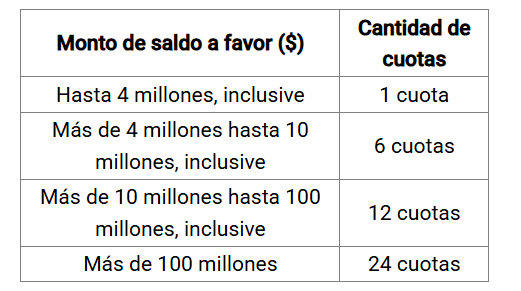

The installment refund scheme remains in place, with 1 to 24 monthly, equal, and consecutive installments, depending on the credit amount, and including interest calculated on each installment from the date the Sworn Refund Statement is submitted.

The first installment will be made available on December 15, 2025, and subsequent installments will be issued within the first five business days of each calendar month. These funds may only be applied to the payment of import duties.

Installment Refund Scheme:

Procedure

- Importers must access the aforementioned Register with their tax ID credentials and submit the “Sworn Refund Statement of PAIS Tax Advance Payments on Goods Imports (DJIP)”.

- The information provided in the sworn statement will be cross-checked against ARCA’s databases. If no inconsistencies are found, a credit will be automatically generated in the Malvina IT System (SIM), usable exclusively for import duty payments.

- If the sworn statement does not pass the automated validations, the system will return an error, generating a file detailing the identified inconsistencies and listing the rejected transactions. Once corrected, a new sworn statement may be submitted.

As noted, participation in this procedure is optional for importers. However, electing to use this special regime implies:

- Waiver of any other administrative or judicial remedy for requesting the refund of the involved amounts; and

- Withdrawal of any refund request or ongoing administrative/judicial action previously initiated for the same amounts.

Since the procedure is voluntary, importers who have already submitted refund claims through other channels should assess whether to continue pursuing those claims or withdraw them and opt in to this specific refund procedure.

In doing so, it is important to consider that utilizing this regime may result in the loss of interest accrued under previously submitted claims. Additionally, importers must assess the feasibility of fully applying the resulting credits solely to import duty payments.